What is Crypto and is Crypto Investment Safe in 2024?

Crypto investment is a new type of investment which began recently. The first cryptocurrency known as Bitcoin started in 2009. We will discuss in detail about Crypto and Crypto investment in this article.

Table of Contents

What is Crypto?

Crypto or cryptocurrency is a type of digital currency that exists virtually or digitally. Its transactions are secured by cryptography. That’s why it is almost impossible to create its fake copy. They are not controlled or regulated by any central authority. They use decentralized systems to secure transactions and to issue new units.

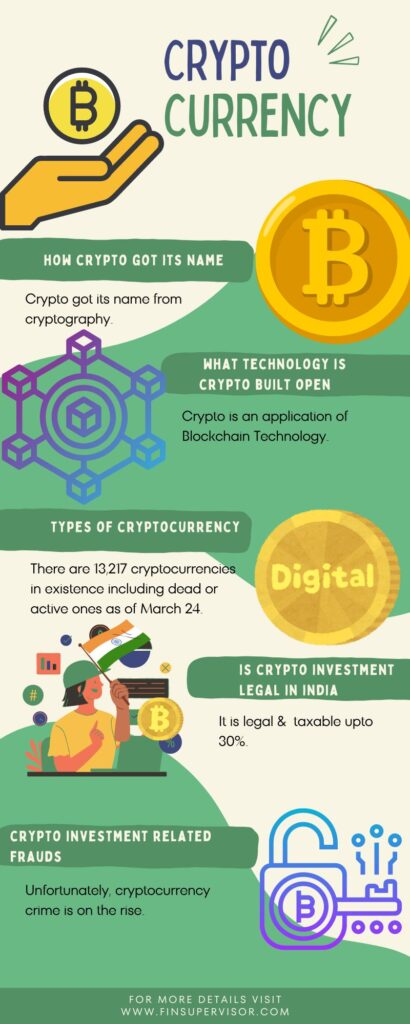

How Crypto got its name?

Cryptocurrency got its name from cryptography which is a process of securing any data so that only the person for whom that data was intended to can see it. It uses encryption algorithms to secure transactions.

How are transactions done on Crypto?

There is no centralized authority or any bank involved in crypto transactions. Hence the mode of transaction here is Peer to Peer where one can send payment to anyone from anywhere. There is no physical money over here. Any transaction done is recorded in the form of digital entries in an online public ledger.

Concepts related to Crypto

1. Currency vs Money

Each country has its own currency. For example Indian currency is INR. Currency is regulated by the government. It can also be manipulated by the government. For example Rs. 2000 note was an Indian currency. Government banned it, after which it has zero value.

Money on the other hand has value to it. Its value can’t be zero as it has value stored in it. For example gold, silver etc they have value. Government can’t ban it. It has value in all other countries as well. One country Currency may or may not be acceptable in another country but money(like gold, silver) are acceptable throughout the world. This is why currency and money are different. Currency can be printed any no of times by the government but money is a limited resource. For instance Gold is extracted through mining and we have limited resources of it.

2. Centralised vs Decentralised

Currency is controlled by government. This is called as centralised system. Government can print as many currency as it wants. This is the major cause of inflation. Decentralised on the other hand is not controlled by any authority or government. For example Bitcoin. Bitcoin can’t be created or mined unlimited no of times. It has a limited resource or supply. Thus it also has a value stored in it. Hence it is similar to gold or silver.

The currencies of one country can impact the currency of another as they are very interconnected. China once dropped its currency. This had an impact on the stock market of USA. As a result the currency of US also dropped. So if a government manipulates its currency it may affect the whole world. In order to get rid of this, a new type of currency was developed known as cryptocurrency which was decentralised.

3. Fiat Currency

The currency of any government is called fiat currency. For example INR, USD, YEN, EURO etc. Earlier any country could print only that much amount of currency as its gold reserves or assets. But in todays date country is printing currency without being banked by any assets or gold reserves. So they can print as many currency they want. One such example is of Zimbabwe. Their economy went bankrupt due to printing a lot of currency.

Since Fiat currency can be manipulated by government people think that its a fake currency. It is not backed by any gold or assets. So its a suggestion if you have a currency, convert it into asset like gold or silver or invest it into a land. As a result the value of your money won’t depreciate. Also you will not be affected by inflation.

4. Digital vs Physical currency

Before Corona, people trusted a lot in physical currency but not in Digital currency. People didn’t have strong faith in digital Platforms like PayTM at that time. As they trusted only the money in bank is safe. What if PayTM or any other platform ran away with our money. But after corona, people started trusting digital payment platforms like PayTM, GPay, PhonePE, UPI’s etc.

This money involved here is digital money. Physical currency can be stolen, torn, misplaced but not the digital money. So now-a-days most of the transactions are digital rather than hard cash. Crypto is also digital money. You don’t get any physical coin of crypto when you buy them. It is present in a digital format. There are multiple platforms to do crypto investment which are mentioned later.

5. AltCoins

Cryptocurrencies other than Bitcoin are called as Altcoins. This is to distinguish them from the original.

What technology Crypto is built upon?

There is a famous saying that nothing can stop an idea whose time has come. That idea is Blockchain. Crypto is an application of Blockchain technology. Another application that is based on Blockchain is Web3.0. There are various ways of achieving what blockchain does but blockchain is the most popular way.

A lot of what we will do in the near future would definitely be powered by blockchain. It is fundamentally different way of peer to peer connectivity. There are 2 key elements of blockchain – one is that it is distributed, second is it has a shared memory. Blockchain is actually a chain of blocks. This block stores data in an encrypted form in a decentralized system.

For example for Bitcoin there is a separate chain of blocks. That block stores transactions in an encrypted format. This chain of blocks is stored at multiple nodes. If a new transaction is done on bitcoin, then this transaction is first verified at various nodes level. If majority of nodes give approval of the transaction then a block related to that transaction is added to the chain. The new chain is then communicated to all the nodes of the Bitcoin system and the blockchain is then updated at all the nodes of the system.

This is how data in blockchain is decentralized and uses shared memory for storage in an encrypted format. If a person tries to change the existing block (data) deliberately then it is sent for verification to all other nodes which then identifies that there is some problem and reject that digital entry. This is how the digital ledger is maintained publicly in secured manner.

Types of Crypto

There are multiple crypto currencies (ranging in thousands) where you can invest. There are 13,217 cryptocurrencies that exist as of March 2024. However, not all of them are active. There are some ‘dead’ cryptocurrencies also. After leaving the dead or inactive crypto, the active cryptocurrencies comes to around 8,985. Total no of cryptocurrency users in the world are around 560 million.

Some of the best known are:

1. Bitcoin

The world’s first cryptocurrency was Bitcoin. A research paper was published in 2008 related to Bitcoin. When Satoshi Nakamoto first created Bitcoin, their was a limit defined for bitcoin which was 21 million. The rule states that when the total no of bitcoins reaches a maximum value of 21 million, no more Bitcoin will be issued. No of bitcoins which have been mined uptill now is 19,769,606.25. Bitcoin operates on its own blockchain. Bitcoin market capitalization is at USD 1.3 Trillion in April 2024.

2. Ethereum

Like Bitcoin, Ethereum operates on its own blockchain. It was developed in 2015. There is no capped limit on Ethereum coins. Hence any no of Ethereum coins can be mined. Apart from Cryptocurrency it offers framework to develop applications on this platform.

3. Litecoin

Litecoin was developed in 2011 by Charlie Lee. It is similar to Bitcoin. Due to this similarity it is sometimes known as the “Silver to Bitcoin’s Gold”. It offers low transaction fees and gives faster confirmation of transactions.

4. Binance

This coin is issued by Binance exchange & traders. It runs on Ethereum blockchain. There is a maximum limit of 200 million for BNB tokens. One can use BNB in a wide range of applications and use cases.

5. Dogecoin

It was introduced in 2013. It was made to make fun of the wild speculations in cryptocurrencies. It is also called as “meme coin” or the first dog coin.

How Crypto Investment works?

There are 3 steps involved in doing Crypto Investment :-

1. Select a Platform

There are two options in this:

a) Traditional Brokers:

They offer facility to buy or sell cryptocurrency along with other financial assets such as stocks,

bonds, ETF’s. They have lower trading cost but few cryptocurrency features.

b) Cryptocurrency Exchange:

There are multiple options in cryptocurrency exchanges. Each one offers different

cryptocurrencies, have their own security features, have their storage and withdrawal options, and

charge their asset based fees. Hence select the exchange accordingly.

2. Add money to your account

After selecting the platform, you need to add money to your account in order to start the trading. You can use fiat currencies such as US Dollar, Indian Rupee, Euro etc on most of the crypto exchange platform to purchase crypto. You can use either your debit card or credit card.

Some exchanges don’t support credit card. Some credit card companies disallow crypto transactions. This is because there is a lot of risk involved in cryptocurrencies. Time taken for deposits or withdrawals vary in exchange platforms. Different platform have different fees for deposit and withdrawal. Their security features are also different. Thus you need to select the platform after doing your research.

3. Buy or Sell Crypto

You can buy or sell crypto either through broker or through exchange platform. You clock on Buy and enter the amount of cryptocurrency you want to purchase and confirm your transaction. Similarly you do for Sell.

Other Crypto Investment options:

There are payment gateway companies like PayPal, Cash App, Venmo etc which gives facility to buy, sell or hold cryptocurrencies. Apart from this there are other ways to invest in crypto like:

- Bitcoin trusts: Investors can buy shares of Bitcoin trusts with a regular brokerage account of stock market.

- Bitcoin mutual funds: Investors can also invest in Bitcoin ETFs and Bitcoin mutual funds.

- Blockchain stocks or ETFs: You can buy stocks or ETFs of companies using Blockchain technology.

Choose the investment option based on your goal and risk appetite.

Is Crypto Investment safe or not?

Do the complete research on cryptocurrency. Know the technology behind them and then invest. Every coin is designed with a specific purpose. After knowing that you would be at a better place to decide in which one to invest. It might happen you are investing in a particular coin but 5 years down the line it got finished. So invest wisely after doing research.

Crypto investment is meant for long term investment and not meant for making money in short term. For short term it will be called as trading but for long term it is called as investment.

Like in stock market you invest in bluechip stocks which don’t give you high rewards but in long run give you good returns. Similarly you invest in good crypto like bitcoin, ethereum etc which give slow rewards but are safe comparatively.

Various Crypto Investment platforms

1. CoinDCX

2. Binance

3. Mudrex

4. Crypto.com

5. Zebpay

6. CoinSwitch Kuber

Is Crypto Investment legal in India?

Crypto investment is legal In India and is taxable upto 30%. Though it is not regulated by government but government is approving of the blockchain technology being used in cryptocurrency and it is suggesting to implement the same for its digital currency like UPI to ensure safety.

Where can you use Cryptocurrency?

Crypto Investment related courses

https://www.udemy.com/courses/finance-and-accounting/cryptocurrency-and-blockchain

https://www.coursera.org/search?query=cryptocurrency

Cryptocurrency related Frauds

Summary

For more details you can Contact us here.

I love the depth of your articles.

Thanks Jody Vasaure. Means a lot. I will try my best to write more articles like this.

I found this post incredibly useful. The tips and insights you’ve shared are going to be very helpful for my work.

Thanks Gillian Jesmer. Your message motivates me to learn more & write more relevant articles. I would more than happy if you can share the topics or ideas on which you want me to write.

This is very practical advice.

Thanks Thomas Goldade. This will inspire me to do more research on the topics. Do you want to share any idea or topic on which I can write something?

I’ve been struggling with this topic, and your post really helped.