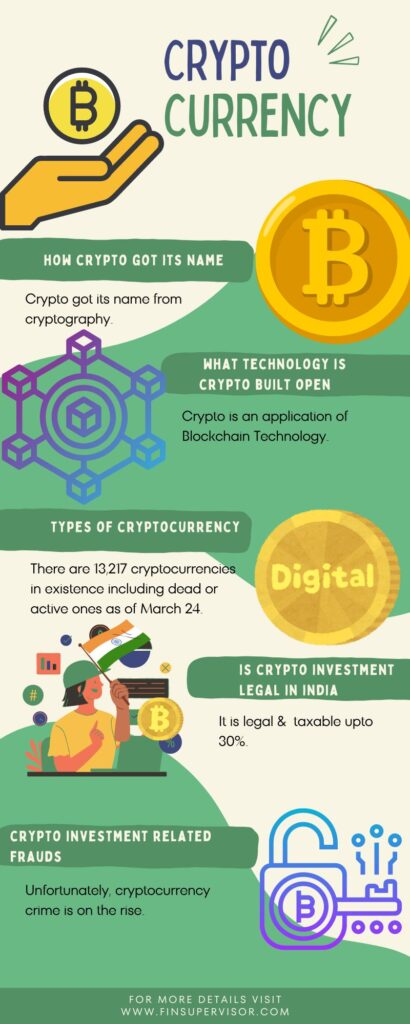

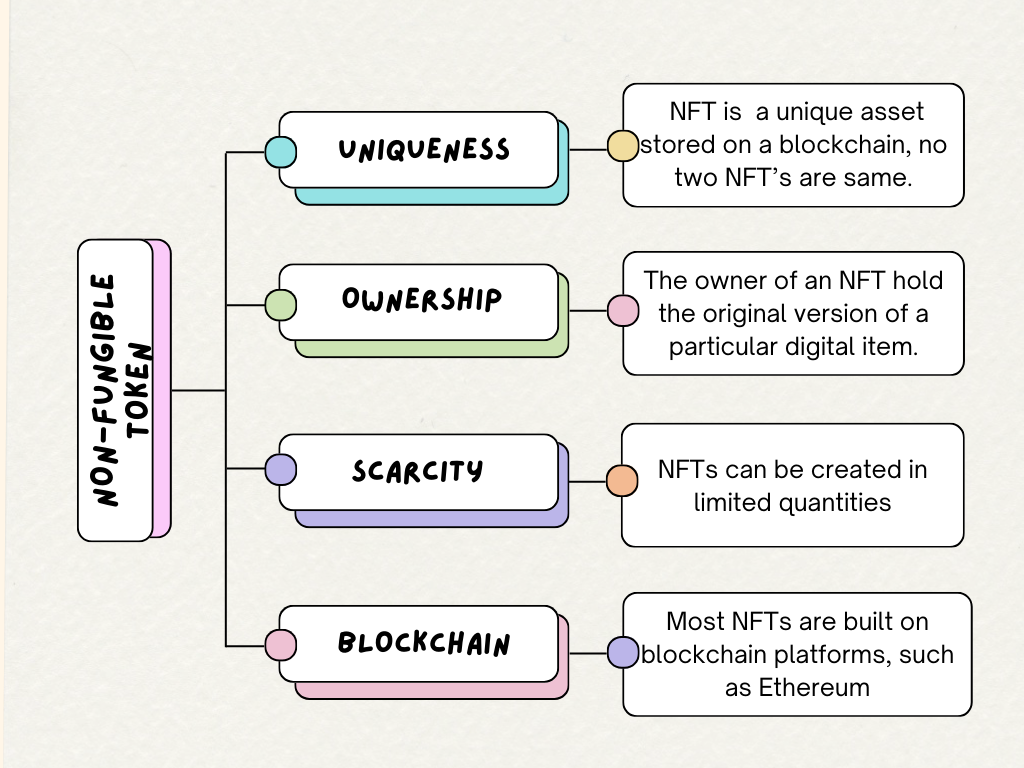

NFT stands for Non-Fungible Token. Each NFT Token is different and cannot be exchanged with one another.

Fungible means that each item is identical and can be exchanged with one another example Cryptocurrencies like Bitcoin, Binance, Etherium etc. NFT’s being non-fungible, means each token is different and cannot be exchanged with one another. It is a unique digital asset. It provides authenticity and ownership to a specific item. This item can be in the form of art, music, videos or virtual items in games.

Table of Contents

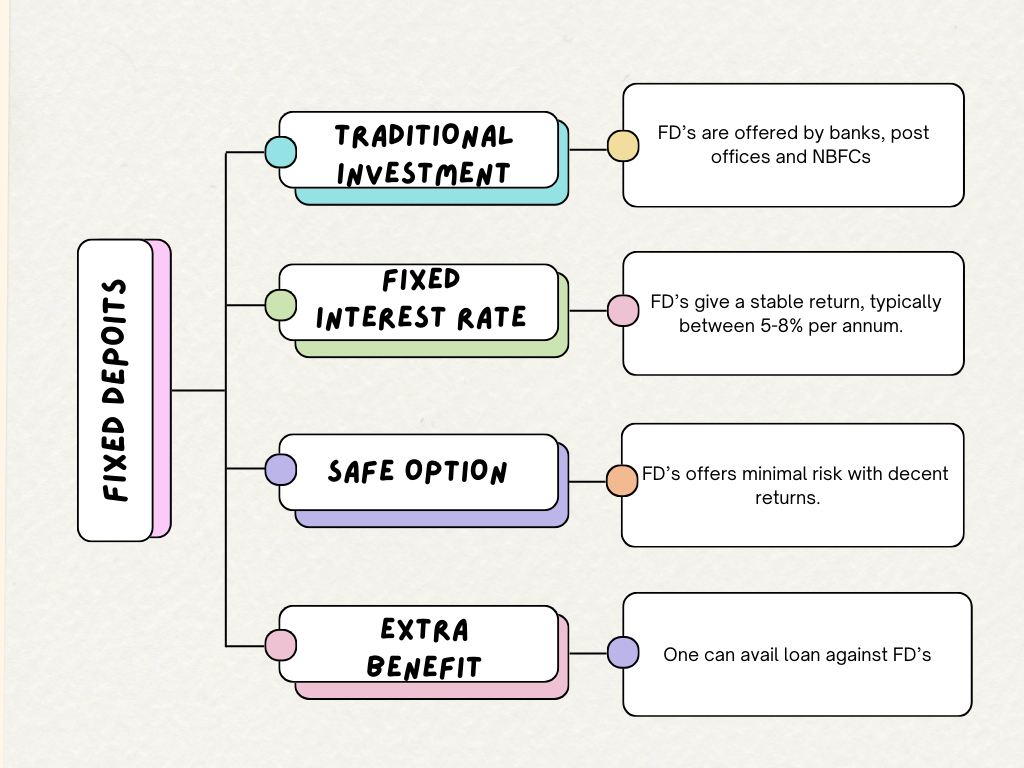

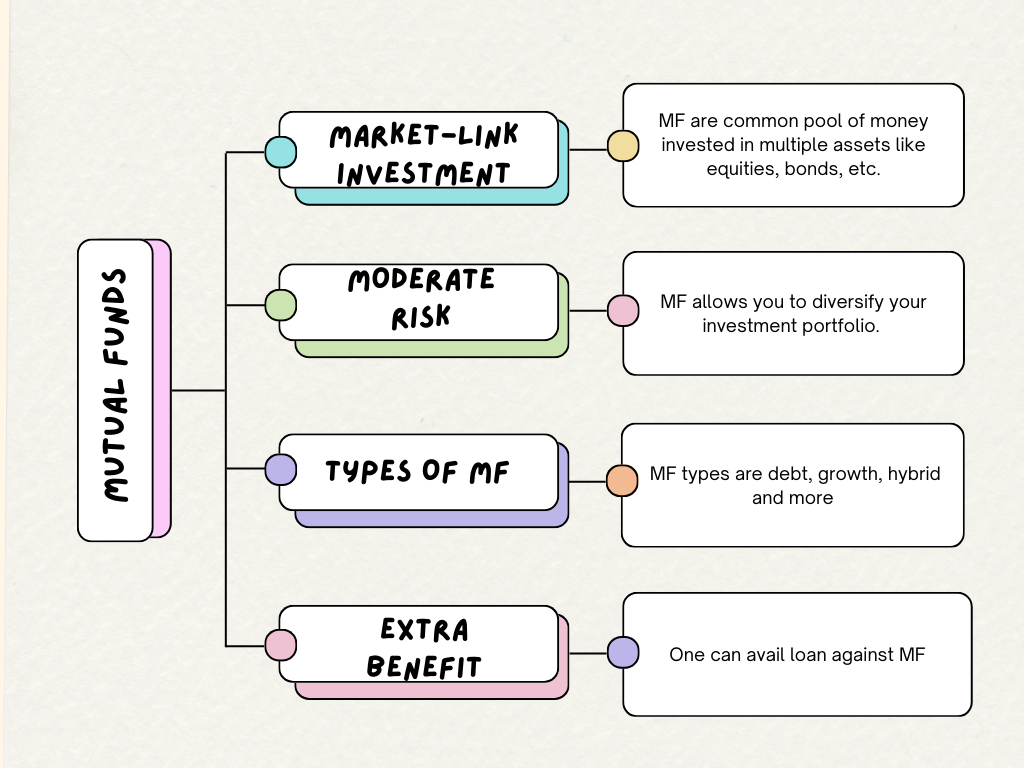

Key Features of NFT

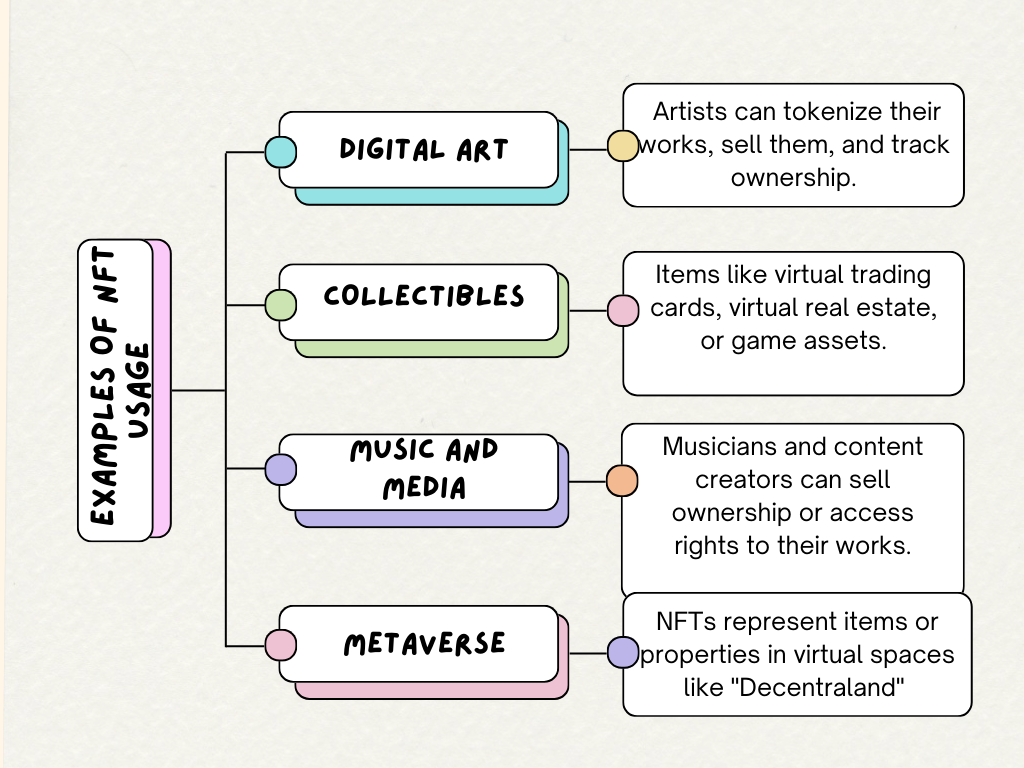

Use Cases of NFT

NFT became popular in 2021, when few of the digital art items were sold in millions of dollars.

How NFT works?

Step-by-step procedure of working of NFT:

1. Blockchain Technology:

NFTs are developed on Blockchain technology which is a decentralized system. Majority of NFTs are built using Etherium blockchain. But there are other blockchains as well which support NFTs like Solona, Flow etc. In blockhain all the transactions are recorded thus one can verify who owns a particular NFT.

2. Tokenization (Minting)

An NFT is created by creating a unique token on blockchain. This process is known as minting during which digital content like art, music, videos etc is attached to a unique token. This token entry is stored in the blockchain thereby making sure that NFT are unique and they can not be copied, altered or destroyed.

The process of creating an NFT is called minting. During minting, digital content like art, music, videos, or virtual items is tied to a unique token. This token is recorded on the blockchain, and this entry ensures that the NFT cannot be copied, altered, or destroyed.

Etherium which is used to create NFTs uses Smart Contracts with the terms mentioned within the code. These contracts manage ownership, transfer and royalty rights when the NFT is sold to someone.

3. Ownership

When someone buys an NFT, they own a token that points to the digital item stored on a server. Only one person can own a specific NFT at a given point of time, even if the digital file is copied or downloaded by others.

4. Marketplaces

People can list, buy and sell NFTs on various marketplaces using cryptocurrency mainly Ether. Examples of these platforms are:

5. Standards

Their are specific standards related to NFT. These are:

ERC-721: It is the common standard for NFT on the Ethereum blockchain. It says that each token must be unique or non-fungible.

ERC-1155: It is a multi-token standard which allows both fungible and non-fungible tokens in the same smart contract.

6. Real life Utilities of NFT

Use cases of NFT can be in the form of Digital Art, music, gaming, Virtual Real Estate, Collectibles and Domain Names. Click here to know more.

7. Resale

There is a mechanism of royalties through smart contracts. In this the original creator of NFT can earn a share of the sale whenever NFT is resold. Thus it provides long-term earning option for artists and creators.

8. Authenticity

Since NFT uses blockchain, there’s a public record of transactions of NFT indicating their ownership. We can verify authenticity and scarcity of digital items. It depends upon the artists, how many copies of digital artwork they want to mint, thus making the asset rare and valuable.

9. Environmental concerns

There is an environmental impact of NFTs which are based on Ethereum as minting and transactions on blockchains consume lot of resources.

In short, NFTs work by creating a unique, verifiable digital asset on a blockchain. They enable creators, artists, and collectors to trade and monetize digital content securely.

Can NFT be converted to cash

Yes, NFTs can be converted into cash, but there are a few steps since NFTs are mainly bought and sold using cryptocurrency. These steps are as follows:

- Go to NFT marketplace and sell the NFT for cryptocurrency.

- Transfer the cryptocurrency you obtained to a crypto exchange.

- Sell your cryptocurrency for fiat currency (like USD, EUR, etc.).

- Withdraw the cash to your bank account.

Which NFT is the most expensive?

The most expensive NFT ever sold (as of 2023) is “Everydays: The First 5000 Days” by digital artist Beeple (Mike Winkelmann). This artwork was sold for $69.3 million in March 2021 at a Christie’s auction.

Other Expensive NFTs are listed below:

- CryptoPunk #5822 – This NFT was created by Larva Labs and was sold for $23.7 million in February 2022.

- CryptoPunk #7523 – This NFT is known as “Covid Alien” due to its mask. It was sold for $11.8 million in June 2021 at a Sotheby’s auction.

- Beeple’s “Human One” – This is a hybrid physical-digital sculpture combined with an NFT. It was sold for $28.9 million in November 2021.

- XCopy’s “Right-click and Save As guy” – It was sold for $7.09 million in December 2021.

When was NFT launched?

NFTs were first conceptualized and launched around 2014, but they gained significant popularity in 2017.

Key Launch Dates:

- 2014: First NFT-like concept was introduced by Kevin McCoy.

- 2017: The launch of ERC-721 standard, CryptoPunks, and CryptoKitties officially marked the beginning of the NFT era.

- 2021: Explosive growth in the NFT market took place in 2021 and were adopted widespread.