How to do Stock Investment safely in 2024?

Table of Contents

What is Stock Investment?

Stock Investment basically means to invest in companies’ stocks or shares. It is one of the most popular investment idea in India. When you own a stock or a share of a company you are actually owing a part of the company that’s why it is called a share. Investing in the stock market can give you high returns, but it also involves high risks.

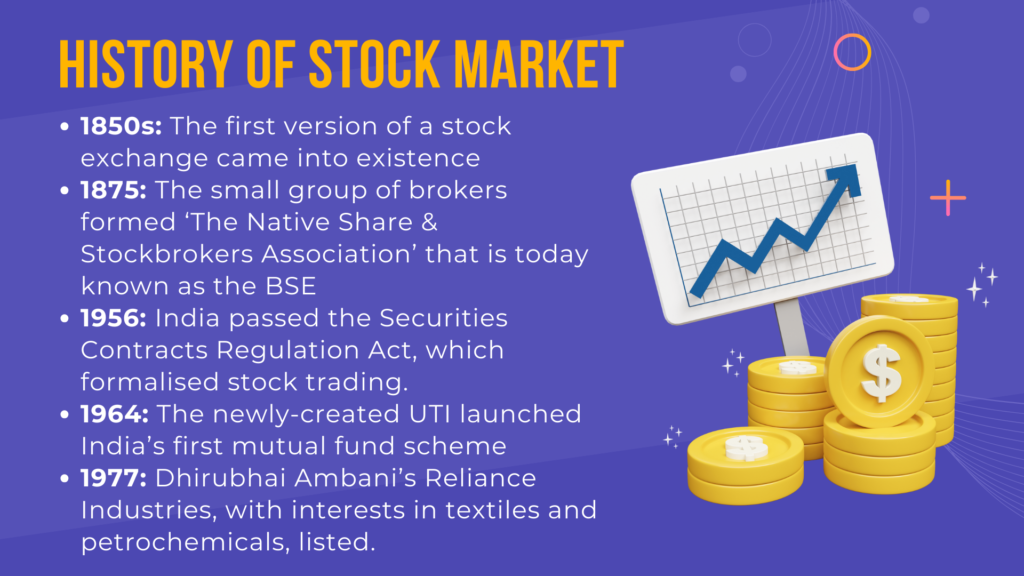

History of Stock Investment

Stock Investment for Beginners

If you are a beginner and you want to invest in stock market, then you need to first ask yourself why have you come here for investing, if it is because of these 3 reasons then my advice is that you should not do stock investing.

1. You have heard from your relative or friend that they have made a huge money in stock market.

2. You have read in the newspaper that people have earned around 300-400% in an IPO launch which is not completely true.

3. You have heard that a particular share value has increased over a lot in a small period of time, so you also want to trade in it and grow your money rapidly.

But if you have come here for following two reasons then stock investment is meant for you and you have come at the right place to begin with. These reasons are:

1. You know that the value of your money is going down by 0.5% every month considering inflation rate as 6%. So you want to invest your money so that you can beat inflation. Then it is a valid reason for stock investment.

2. You want your money to make more money for you. Just like there are lakhs of people working day and night for Tata’s or Ambani’s helping them to grow their money. They let their money work for them. This is how the rich people become more richer as they leverage the power of their money in making more money.

Steps to do Stock Investment Safely

There are chances of losses in Stock Investment. But there are ways to reduce those risks. With following steps you can do stock investment safely. These include analyzing your goals, your risk-appetite, your time-horizon etc. These steps are explained below:

1. Make SMART Goals

You should be clear about your investment goals. Goals will help you make investment decisions wisely and stay focused. You need to set both short-term & long-term goals. As you will make your investment strategy accordingly. Short term goals like saving for a vacation, long-term goals like child’s education, planning for early retirement. For long term goals you can take high risk but for short term you can’t be aggressive.

Your Goals should be SMART meaning:

- S – Specific

Your goal needs to be specific and narrow for effective planning. - M – Measurable

You should be able to measure the progress of your goal. - A – Achievable

That Goal should be achievable within a certain time frame. - R – Relevant

Goal should align with your values and long term objectives i.e. it should be relevant. - T – Time Bound

Set the timeline of goal which is achievable and motivates you to prioritize accordingly.

2. Calculate how much you can put into Stock Investment

List all your sources of income. Keep aside an emergency fund for covering your expenses for at least 3 to 6 months such as your EMI’s, your monthly rents and other essential bills. Its recommended to pay your high interest debts such as credit card dues. After all these calculations you will get an idea of how much money you can put into stock investment.

FYI – There is a Minimum 10% rule – which says that you should invest at least 10% of your income every month in long-term investments. Simultaneously you should increase your investment amount every year by 10%. Then after a period of 20 years, it will give you very high returns because of the power of compounding, provided you need to be patient.

Even if your funds are small for investment, don’t worry. Just remember, investing is a Marathon, not a Sprint, its a long journey ahead.

3. Evaluate your Risk Capacity

It is a necessary step to evaluate as returns in Stock Market are unpredictable. You may loose everything over here or you may earn indefinitely. So invest only the amount you can take risk of. Higher risk may give you high returns and reverse is also true.

Also you need to see your timeline. If you have bigger timeline you can take higher risk as will give you time to recover from potential losses. But if your timeline is small, you need to do conservative investments. Select stocks based on your risk taking capacity. For Example:

| Risk | Stock Investment Asset |

| Low | Dividend Stocks & Bonds |

| Medium | Mid-Cap & Large Capitalization Stocks, Index Funds, Exchange Traded Funds |

| High | Small Cap Stocks, Growth Stocks, Sector Specific Investments |

Your risk capacity may change with time so adjust your investment strategy accordingly.

4. Strategy to pick Stock wisely for Stock Investment

By purchasing share of a company you start owning that business and let professionals working in that company, work for your business growth, thereby giving you profits.

How do you select a particular stock or how do you choose a company as its a big task of selecting 10 to 20 companies out of a total of 5000 companies. Also we don’t have that much time after coming from work or office to do research on companies and then select the ones that we feel will perform well.

So strategy that I follow in selecting a company is to see the most common brands that we find in our surroundings. We ourself are a witness of that company performing well because of its regular customer base, we see in our day-to-day basis.

You yourself list down 15-20 companies from your daily routine whose product you, your friends & your relatives use in their daily routines. Just note down the companies as we proceed further. Assume yourself in such situations and list down the companies whose products you see or consume.

- We start from the morning, in morning when we getup, we use brush & toothpaste, so which Company paste or brush you or your loved ones use. Note it down.

- Which company soap, shampoo, oil you or your friends/relatives commonly use.

- Then you drink Milk, Tea or coffee so which brand you prefer.

- After that you go to office via cab. Which app you use to book your cab.

- When you work in office, the software that you work on was designed by which company, the communication channel that you use in your office belongs to which company. The gadgets that are their in your office are of which company.

- At lunch time when you order food from outside through which platform you order your food.

- From which restaurant or food chain you order your food.

- From which mode you make the payment, which bank app, credit card/debit card you like.

- At which company you work in. You know a lot about your company where you spend daily around 10 hrs. You know how it is doing. If it’s performance is good, start owning your company by buying its shares instead of just working for it. You might also have the knowledge of its competitors. If you feel your competitor company is performing better then start buy its shares.

- At evening which outlet do you go to drink your coffee or have snacks.

- When you plan to go for watching movie which multiplex you prefer.

- The clothes that you buy are from which brand. Your formal clothes, your casual clothes.

- Which company shoes, wallet, belt, watch you wear.

- At home which company AC, TV, dishwasher, Washing Machine or other appliances you use.

- Which company Laptop or Mobile you use.

This way you can select the company whose shares you should buy. As these companies have been part of your life for so long. You and a lot of people near you are a customer base of such companies, you have known their business model for long.

So start owning these companies by owning their stocks, don’t just be their customers. I can’t guarantee but I am sure that if you stick with this strategy and invest in 10 or 15 or 20 stocks accordingly, you will change your life or your spouse life and definitely your children’s life in over a period of 20 years due to company’s steady growth and using the power of compounding.

You can’t guarantee in stock market that this strategy will work 100%, as anything can happen in the market. But this is my belief, if you follow it then you will get good returns in time.

5. Diversify your portfolio in Stock Investment

This is the benefit of creating diverse portfolio in the stock market. Invest in multiple stocks(say 10-15) rather than just one or two. So even if say out of 10, 7 stocks not worked as expected but remaining 3 will give you so much benefit that you will end up with good average returns in your portfolio. Because you never know which stock might fall.

Stock market has the power of converting your 100 to zero and reverse is also true i.e. from 100 it can take you to infinity. So give your time in the stock market of around 20 years, be patient and I believe you will surely get success.

I know this might feel boring but believe me boring investment gives you good returns in time. Don’t buy any stock which is hyped or of any xyz company about which you don’t have any knowledge or you don’t know its track record and just that it is claiming hypothetical things like it will go to moon and bring water etc. Because such hyped companies stocks are over priced. You might enter into loss if that company didn’t deliver what it promised.

Again these are my suggestions. I am not imposing or can not guarantee you anything.

6. Track, Learn & Review

Risks & Benefits in Stock Investment

There are benefits in Stock Investments but there are certain risks involved as well. Both are explained below:

How I buy my first Stock

In order to buy your first stock in India, you need to open a Demat account through a SEBI- registered broker. You need to provide your Aadhar Card & Pan Card details. After the account is set up, you can start trading using the broker’s online platform or mobile app.

Platforms for Stock Investment

Books related to Stock Investment

For more information on Stock Investment, click on Contact Us.

This post has been incredibly helpful in clarifying a lot of the questions I had. Thank you for providing such clear and concise information.

Thanks Burt Dorrance for your feedback. It will boost me to write more articles like this.

I love the examples you provided.

Thanks Jona Barclift. I will try to include as many examples in my articles as possible.