Popular Investment Ideas in India in 2024

If you are looking for some cool Investment ideas to invest, you have landed on the correct page that will list down popular investment ideas in India in 2024.

If you are looking for some cool Investment ideas to invest, you have landed on the correct page that will list down popular investment ideas in India in 2024.

Table of Contents

Meaning of Investment

Investment means to allocate money into an asset or business with the objective of gaining profit from it over a period of time. It is a way of generating wealth thereby enabling you to achieve your financial goals and secure your future.

There are multiple investment ideas where you can allocate your money into depending upon your risk appetite and financial goals for example you can invest in traditional entities like Fixed Deposits(FDs) and gold bonds to modern options such as mutual funds & stocks.

Types of Investment Ideas based on Risk

1. Low Risk Investments

These include investments which have minimal or zero risk providing guaranteed returns. These are meant for those who prefer low risk and safe returns. Investment ideas for this type are Fixed Deposits(FDs), Public Provident Fund(PPF), Sukanya Samridhi Yojana, Gold

2. Medium Risk Investments

These include investments which have slightly higher risk than low risk investments. These are meant for those who are looking for balanced portfolio. Investment ideas for this type of investments are Debt Funds, Corporate Bonds, Government Bonds.

3. High Risk Investments

These include investments which have higher risk than medium risk investments. These are market linked. These are suitable for those who can take more risk for high return. Investment ideas for this type are Stocks, Mutual Funds, ULIPs etc.

| S.No. | Low Risk Investment | Medium Risk Investment | High Risk Investment |

| Risk | Minimal or zero risk | Medium Risk | High Risk |

| Returns | Safe returns | Medium Returns | High or Low returns |

| Return Type | Fixed | Market Linked | Market Linked |

| Investment Ideas | Fixed Deposits, PPF, SCSC, SSY etc | Debt Funds, Bonds etc | Stocks, Mutual Funds, ULIPs |

Top 20 Investment Ideas in India in 2024

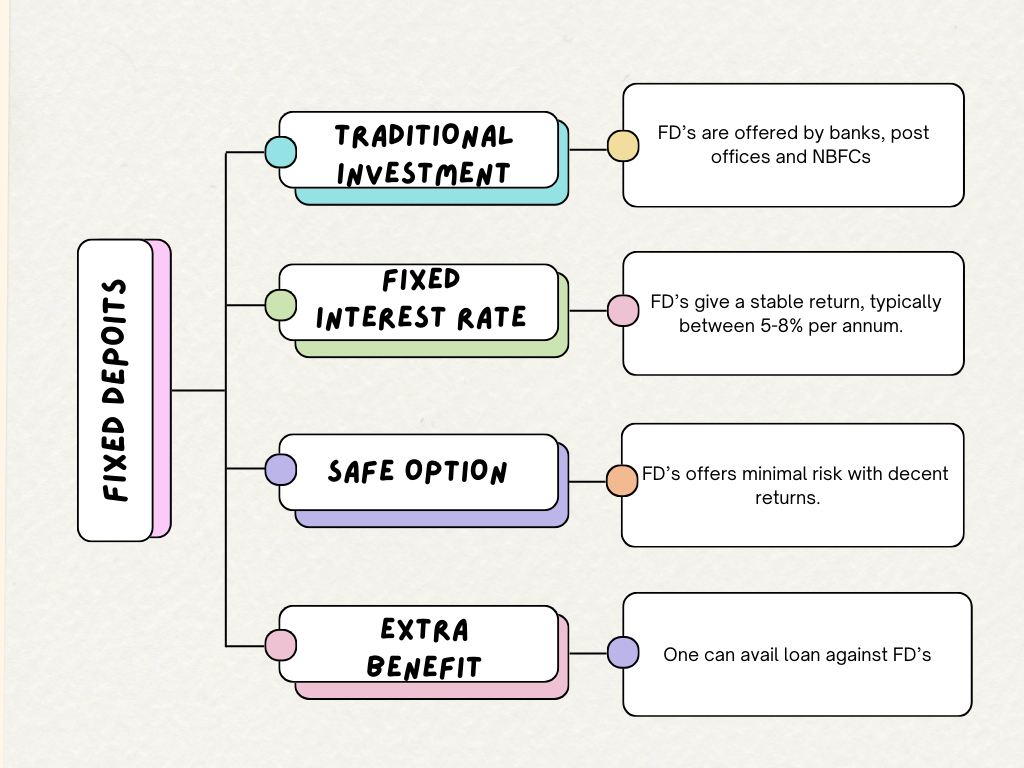

1. Fixed Deposits (FDs)

It is one of the most traditional & popular investment idea where you deposit money for a fixed period of time at a stable interest rate.

- Bank FDs: Offer a stable return, typically between 5-8% per annum.

- Corporate FDs: Higher interest rates but with slightly higher risk.

2. Public Provident Fund (PPF)

PPF is a government scheme meant for long-term investment. Investments here start at just Rs. 500/- per annum. It is an investment idea for retirement.

- Interest Rate: It is approximately 7-8% per annum which is compounded annually.

- Lock-in Period: It is of 15 years duration however partial withdrawal is allowed after specific intervals.

- Tax Benefits: Interest earned and Maturity amount are exempted from tax.

3. National Pension Scheme (NPS)

NPS is regulated by the Pension Fund Regulatory and Development Authority (PFRDA). It is an investment idea for retirement.

- Tax Benefits: Amount invested is eligible for tax deductions under Section 80C and 80CCD.

- Returns: Over here funds are invested in bonds, government securities, stocks etc. thereby giving higher returns as compared to traditional savings plans.

4. Senior Citizen Saving Scheme (SCSS)

SCSS is another government scheme designed for senior citizens in India. Investment idea behind this scheme is to provide a secured source of income for senior citizens during their retirement years.

- Tax Benefits: The principal amount invested is eligible for deduction under Section 80C, up to a limit of ₹1.5 lakh. However, the interest earned is taxable.

- Returns: Fixed Interest rate which is 8.2% per annum (as of Q2 FY 2023-24).

5. Sukanya Samridhi Yojana (SSY)

SSY is a government scheme launched as a part of the “Beti Bachao Beti Padhao” campaign. This investment idea is basically designed for parents who have girl child and want to save for her future. This encourages parents to save and invest for the education and marriage of their daughter in future.

- Eligibility: The scheme is open for parents or legal guardians of a girl child from birth up to 10 years of age.

- Interest Rate: The interest rate is set by the government and is reviewed quarterly. It is relatively higher than other small savings schemes and is compounded annually.

- Tax Benefits: Contributions made to the SSY account qualify for deductions under Section 80C up to a specified limit. Additionally, interest earned and maturity proceeds are tax-free.

6. National Savings Certificate (NSC)

NSC is a savings scheme offered by the Department of Post, Government of India. It is a long-term investment idea where people can invest a lump sum amount and earn a fixed rate of interest over a period of time.

- Investment: There are two options for maturity periods: 5 years and 10 years. Investors can choose the period based on their financial goals and liquidity needs.

- Interest Rate: The interest rate is set by the government and is revised quarterly. When a person purchase the certificate, the interest rate remains fixed for the total period of the certificate. The interest is compounded annually but is payable only at maturity.

- Tax Benefits: Investments made are eligible for tax benefits under Section 80C, up to a specified limit. However, the interest earned is taxable and it needs to be declared in the person’s income tax return.

7. Kisan Vikas Patra (KVP)

Kisan Vikas Patra (KVP) is a savings scheme offered by the Department of Posts, Government of India. This investment idea started to encourage people of rural and urban areas to go for long-term investments.

- Interest Rate: The interest rate is set by the government and is revised periodically. This rate remains fixed throughout the tenure of the investment.

- Interest calculation: The Interest here is compounded semi-annually. This means that interest is calculated every 6 months and is added to the principal amount.

- Tax Benefits: Investments made here do not qualify for any tax benefits under Section 80C. Also, the interest earned is taxable according to the investor’s income tax slab.

8. Post Office Time Deposit (POTD)

POTD is a fixed-term investment idea which is offered by Department of Posts, Government of India. It is same as fixed deposit (FD) provided by banks.

- Interest Rate: The interest rates are fixed at the time of deposit and are guaranteed for the entire tenure. Interest is compounded quarterly, ensuring a higher effective return compared to simple interest.

- Tax Benefits: Investments in the 5-year Post Office Time Deposit are eligible for tax deductions under Section 80C. Interest earned on deposits is taxable according to the investor’s income tax slab.

9. Gold

Gold is one of the oldest investment idea of India and a popular one too. This is because it is considered as auspicious metal in India. It is low risk investment. The traditional way of investing in gold is through buying gold ornaments, gold bars or gold coins.

New investment ideas have come up through which one can buy gold digitally via gold deposits, Gold ETFs and Sovereign Gold Bonds. Gold Bonds are financial assets issued by government or financial institutions. They are backed by physical gold. The investment idea behind buying gold digitally is they enable a person to invest in gold without actually owning the physical gold.

- Physical Gold: Jewelry, coins, and bars.

- Digital Gold: Gold ETFs and Sovereign Gold Bonds (SGBs).

10. Government Bonds

Government issues bonds in the form of debt security. It is an investment idea through which government raise capital for serving its various purposes such as paying existing debts, financing infrastructure projects etc.

When an investor purchases a government bond, he/she actually gives loan to the government. Government then promises to pay the investor an interest at a fixed rate for a specific time interval ranging from few months to years. When the bond term is over, government pays the principal amount to the investor. It is considered a low risk investment as it is backed by the credibility of the government.

- Government Bonds: Lower risk with guaranteed returns. Example RBI Saving Bond.

- Corporate Bonds: Higher interest rates but with higher risk.

11. RBI Saving Bonds

The Reserve Bank of India Savings Bond is an investment idea by the Government of India. It is a safe investment option through which one can earn fixed returns.

- Interest Rate: The interest rate is fixed when the bond is issued and remains same throughout the period of 7 years.

- Interest: Interest is paid semi-annually. It is credited directly to the person’s bank account.

- Tax Benefits: Interest earned is taxable under the investor’s income tax slab. Tax is deducted at source (TDS) if the interest crosses a specified limit.

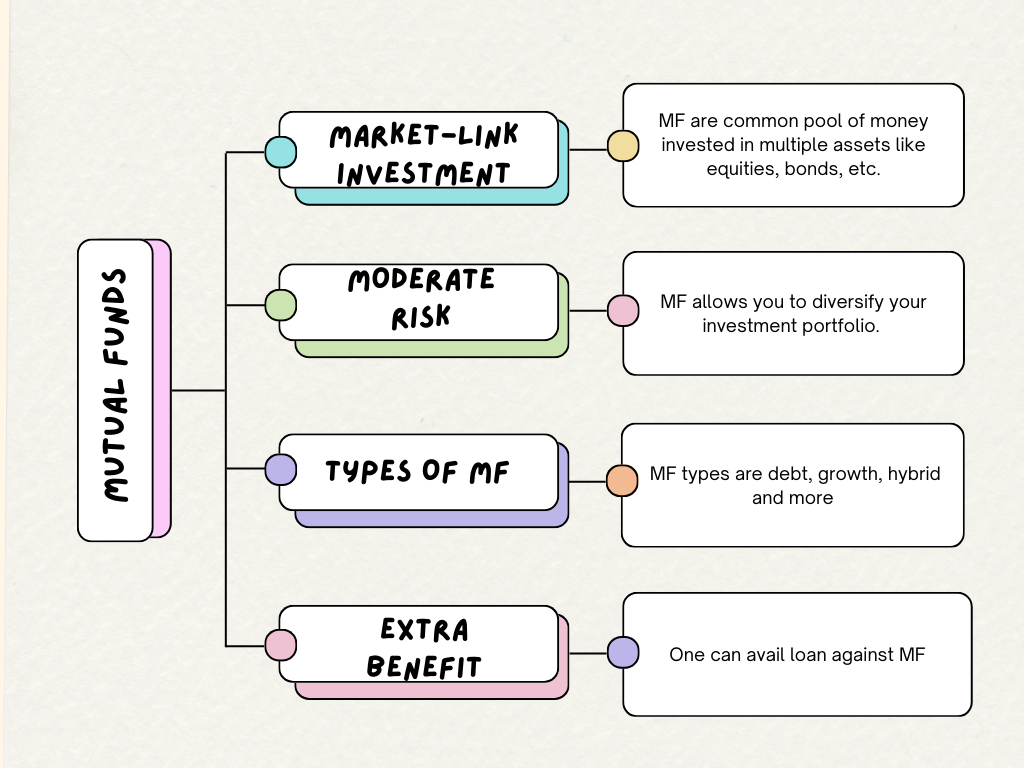

12. Mutual Funds

Mutual funds are a common pool of money invested in multiple assets like equities, bonds etc. These are managed by fund managers who diversify our investment portfolio thereby mitigating risk. There are different types of mutual funds namely debt, hybrid, growth etc. They are meant for both long term and short term investment.

- Debt Mutual Funds: Here investment is done in fixed-income securities, suitable for safe investors.

- Hybrid Mutual Funds: Here investment is done in both equity and debt, thereby balancing risk and return.

13. Liquid Funds

Liquid funds are a type of Mutual Fund which are designed to provide high liquidity and minimal risk. It involves investment in short-term money market assets such as treasury bills, commercial paper, certificates of deposit etc. They are popular choice for investors looking to invest surplus funds for short durations.

- Liquidity: These funds offer high liquidity. Investors can redeem their units and access their money as quickly as one business day.

- Returns: The returns here are higher than those of traditional investment ideas but lower than those of long-term debt funds.

14. Initial Public Offerings (IPO)

IPO is launched by a company when it changes its status from private to public. In this process company offers its shares to the public for the first time. This way company raise funds by selling its ownership in the form of shares to individual and institutional investors.

An IPO helps both the company and the investors. Company gets the required funds from public for its growth whereas the investors get a chance to participate in company’s growth story at the early stages.

There are two types of IPO:

- Fixed price offering:

Here the company fix the price of shares before offering them to the market. This price remains consistent throughout the process of IPO offering. To decide the price, company collaborate with merchant bankers and underwriters. Investors like this IPO due to its transparency. - Book building offering:

Here the company offers price band of 20% on the shares. The minimum share price is called as floor price whereas the maximum share price is known as the cap price. Investors need to specify the number of shares they are going to buy and at what price. Final decision is taken depending upon the investors’ bids.

15. Stock Market Investment

Stocks is one of the most popular investment idea in India. When you own a stock or a share of a company you are actually owing a part of the company that’s why it is called a share. Investing in the stock market can give you high returns, but it also involves high risks. You should do proper research before investing in stocks. Their are different types of stocks based on market capitalization:

- Blue-Chip Stocks: Companies with a history of reliable performance and stable returns.

- Mid and Small-Cap Stocks: Potential for higher returns, though with increased risk.

For more information on Stock Investing, visit here.

16. Real Estate

Real estate is also a popular investment idea in India. It requires a huge amount of investment. The returns are also big. You can also go for monthly rental income over here. It is a good investment idea for long term investment.

- Commercial Property: It provides higher rental income but involves higher investment costs.

17. Real Estate Investment Trusts (REITs)

They are companies that owns and operates income-producing real estate across property sectors. It is an investment idea where one can earn income from real estate without the tension of busing, managing, or financing properties themselves.

18. ULIP’s

ULIP stands for Unit Linked Insurance Plan. It gives us two benefits. One is we get a life insurance cover which protects our family financially from any unfortunate incident. Another benefit is we can invest for on a long-term basis in the fund of our choice. It can be equity, debt or a combination of both the funds depending on our risk-appetite and goals. Thus it is a good option for you and your family’s long term goals.

Benefits of Investing in ULIP’s

- You can choose the amount of life cover that you want. Minimum Life cover offered is 10 times your annual premium. Some companies offer Life cover of even 40 times of your annual premium.

- You can choose where to invest – whether in Equity fund, Debt fund or mix of both i.e. Balanced fund. You also have the option of switching between the funds.

- They are designed to achieve your goals such as wealth creation, retirement planning, saving for your child’s future etc.

- You can save tax by investing in ULIP. You can avail tax benefit on premium payments. You can avail tax benefit on maturity amount subject to conditions on Section 10D.

- There is also an option of partial withdrawal through which you can withdraw a part of your money in the case of emergency like child’s education, family vacation, other emergencies etc.

19. Cryptocurrencies

Cryptocurrency is a digital currency secured by encryption algorithms. It work as a virtual accounting system and is not controlled by any central authority such as government or a bank. Cryptocurrency allows people to make payment directly to each other through computer network. It uses blockchain technology. There are more than 25000 cryptocurrencies. Examples include Bitcoin & Ethereum.

- Volatility: Crypto investment idea is suitable for those who can tolerate high risk as prices can fluctuate significantly.

- Security: Blockchain technology is highly secured but when it comes to off-chain, crypto storage repositories such as exchange and wallets can be hacked.

- Regulation: India is creating a framework for cryptocurrency.

For information related to crypto you can visit this link https://www.kaspersky.com/resource-center/definitions/what-is-cryptocurrency

20. Peer to Peer (P2P) Lending

In P2P lending, a person directly lends money to individuals or businesses without any financial institution acting as an intermediary in between. It is done through online platforms which brings together lenders and borrowers. In this investment idea the borrower has to pay interest to the lender along with the principal amount.

This is how peer to peer lending works:

- A borrower who needs loan goes to online P2P platform and has to fill an online application over there.

- The platform reviews the application and check the risk and credit rating of the applicant. Then, the applicant is assigned the interest rate accordingly.

- On the approval of the application, the applicant receives some options of the investors based on his credit rating and interest rates.

- The applicant selects one of the option out of the available ones.

- The applicant has to pay periodic (usually monthly) interest payments and repay the principal amount at maturity.

How to start investing in above popular Investment ideas?

- Analyse your needs & Risk capacity

- Look for various Investment Ideas listed above

- Select one based on your risk apetite

Things to consider before investing in above popular Investment ideas

- Diverse Portfolio

- Financial goals

- Risk Apetite

- Time Duration

- Research

- Tax Benefit

Some of the Famous Investment Quotes

1. ‘An investment in knowledge pays the best interest’

Benjamin Franklin

2. ‘The stock market is filled with individuals who know the price of everything, but the value of nothing.’

Phillip Fisher

3. ‘How many millionaires do you know who have become wealthy by investing in savings accounts? I rest my case.‘

Robert G. Allen

4. ‘Don’t look for the needle in the haystack. Just buy the haystack!’

John Bogle5. ‘I will tell you how to become rich. Close the doors. Be fearful when others are greedy. Be greedy when others are fearful.‘

Warren Buffett6. ‘Financial peace isn’t the acquisition of stuff. It’s learning to live on less than you make, so you can give money back and have money to invest. You can’t win until you do this.’

Dave Ramsey7. ‘Know what you own, and know why you own it.’

Peter Lynch

Conclusion

Investment is crucial if you want to grow your money in order to beat inflation. With proper investment strategies, you can make money from money. You should diverse your portfolio by investing in multiple financial assets rather that investing in only one. This is because at a time only one or two asset might crash but not the other ones. So its not a better idea to put all your eggs in one basket. Choose your investment ideas wisely based on your goals, risk appetite and timelines after doing complete research on them.

For more information you can Contact us here.